when are property taxes due in will county illinois

And remain down until 830 am July 5th. Find out more.

The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500.

. Tax amount varies by county. Property taxes are due in two installments. In most counties property taxes are paid in two installments usually June 1 and September 1.

The second installment is due September 1. Please use the GovTech website directly for tax payments and inquirys during this time. When are taxes due.

What county in Illinois has the highest property taxes. For now the September 1 deadline for the second installment of property taxes will remain unchanged. The Cook County Treasurers Office mails tax bills and collects payments.

Taxes are paid in four installments and the first installment is due in July the second is in September the third in October and the last in. While taxes from the 2021 second installment tax bill which reflect 2020 assessments are usually due in August the due date was postponed until October 1st. Will County Treasurer Tim Brophy said the board should establish June 3 Aug.

The first installment due June 1 will be accepted without late penalty interest payments if paid on or before July 1. The first is due June 1st and the second is due September 1st. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

Tax Sale Case Numbers. The Second Installment of 2021 Levy Real Estate Taxes is due on September 1 2022. Any payment received on September 2nd or after will accrue penalty at an interest rate.

When are property taxes due in Will County. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

Tax Sale Instructions for Tax Buyers. 2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. Welcome to Property Taxes and Fees.

2019 payable 2020 tax bills are being mailed May 1. The 2021 tax bills will mail on September 1st. Click Here for the List.

Tax Sale Information for Property Owners. Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines. Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes.

Lake County collects the highest property tax in Illinois levying an average of 628500219 of median home value yearly in property taxes while Hardin County has the lowest property tax in the state collecting an average tax of 44700071 of median home value per year. Will County collects on average 205 of a propertys assessed fair market value as property tax. Real Estate system will be down for maintenance beginning Friday July 1st at 5 pm.

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. Will County Treasurers Office. Are Cook County tax bills out.

Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. How do I get my Illinois property tax statement.

173 of home value. 3 as the due dates for 2021. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section.

The Cook County Property Tax System Cook County Assessor S Office

Property Taxes By State In 2022 A Complete Rundown

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

2022 Property Taxes By State Report Propertyshark

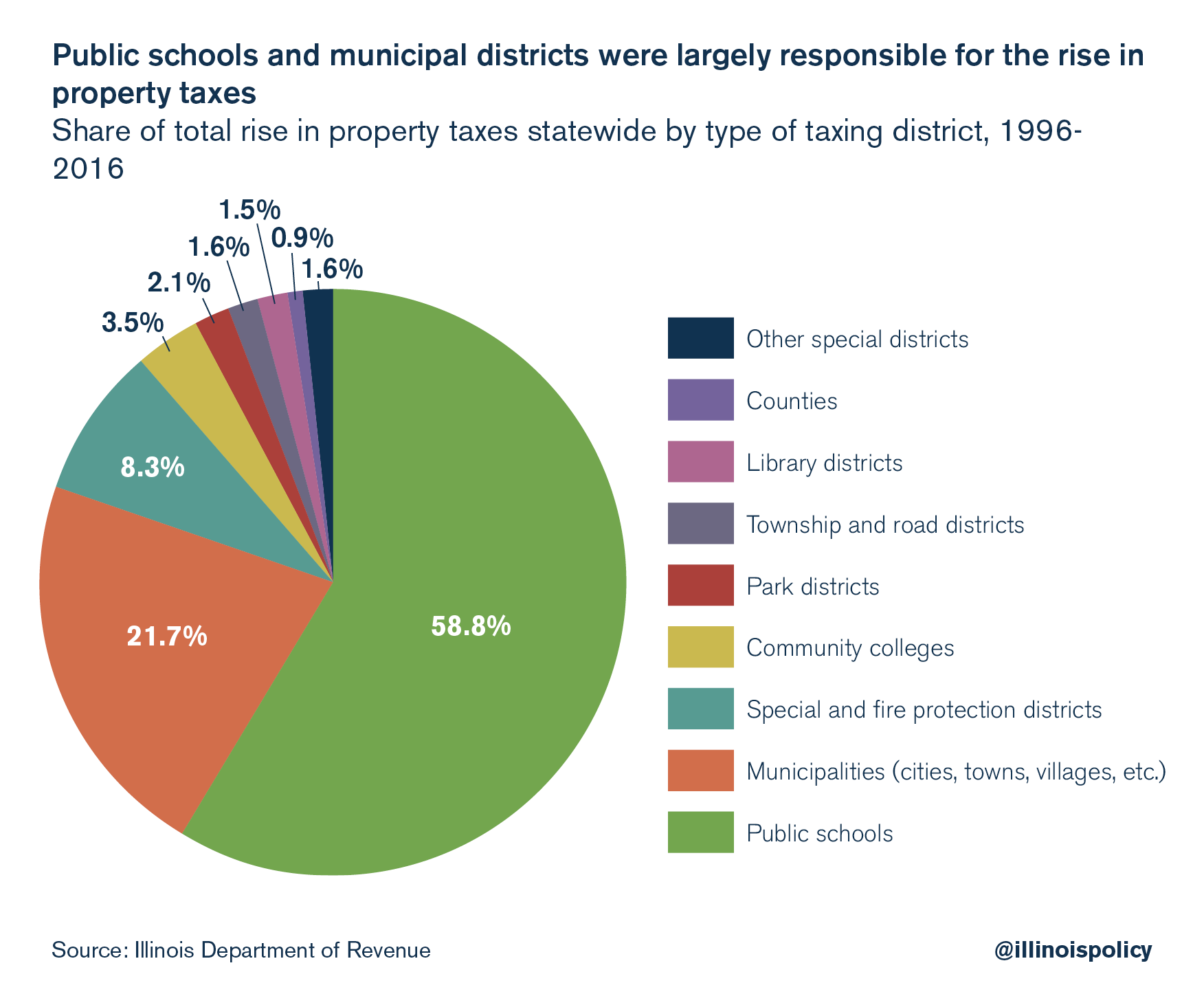

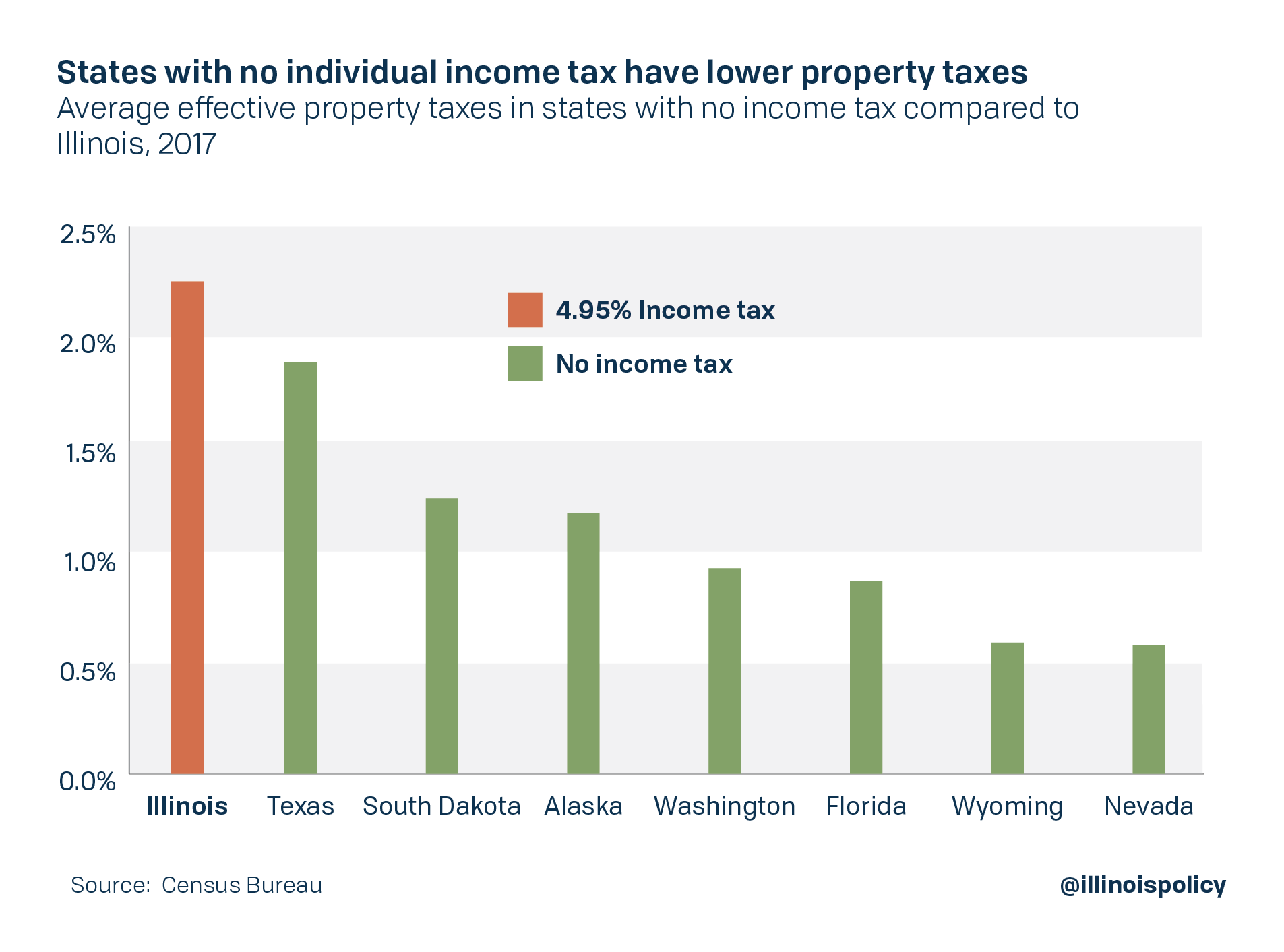

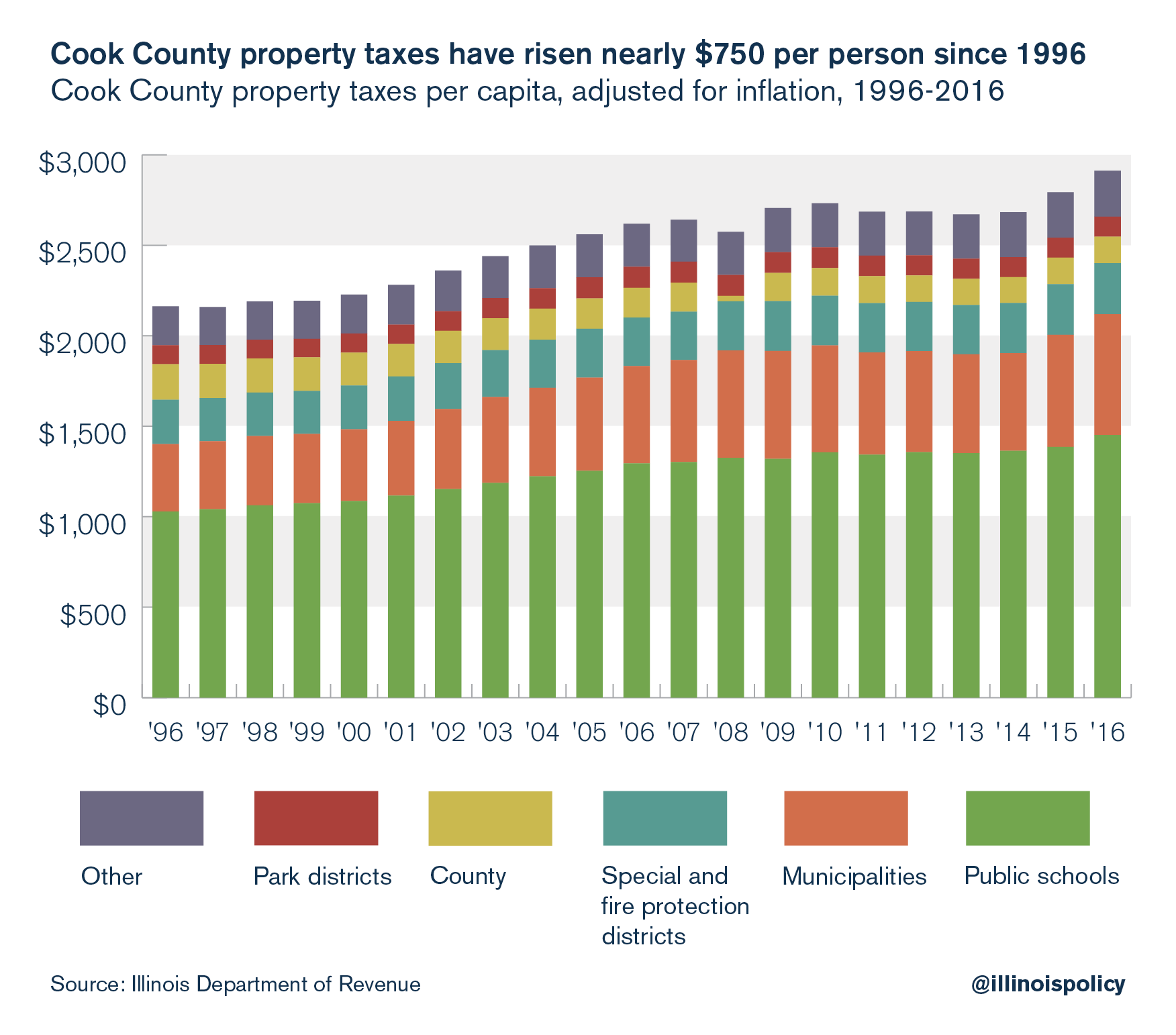

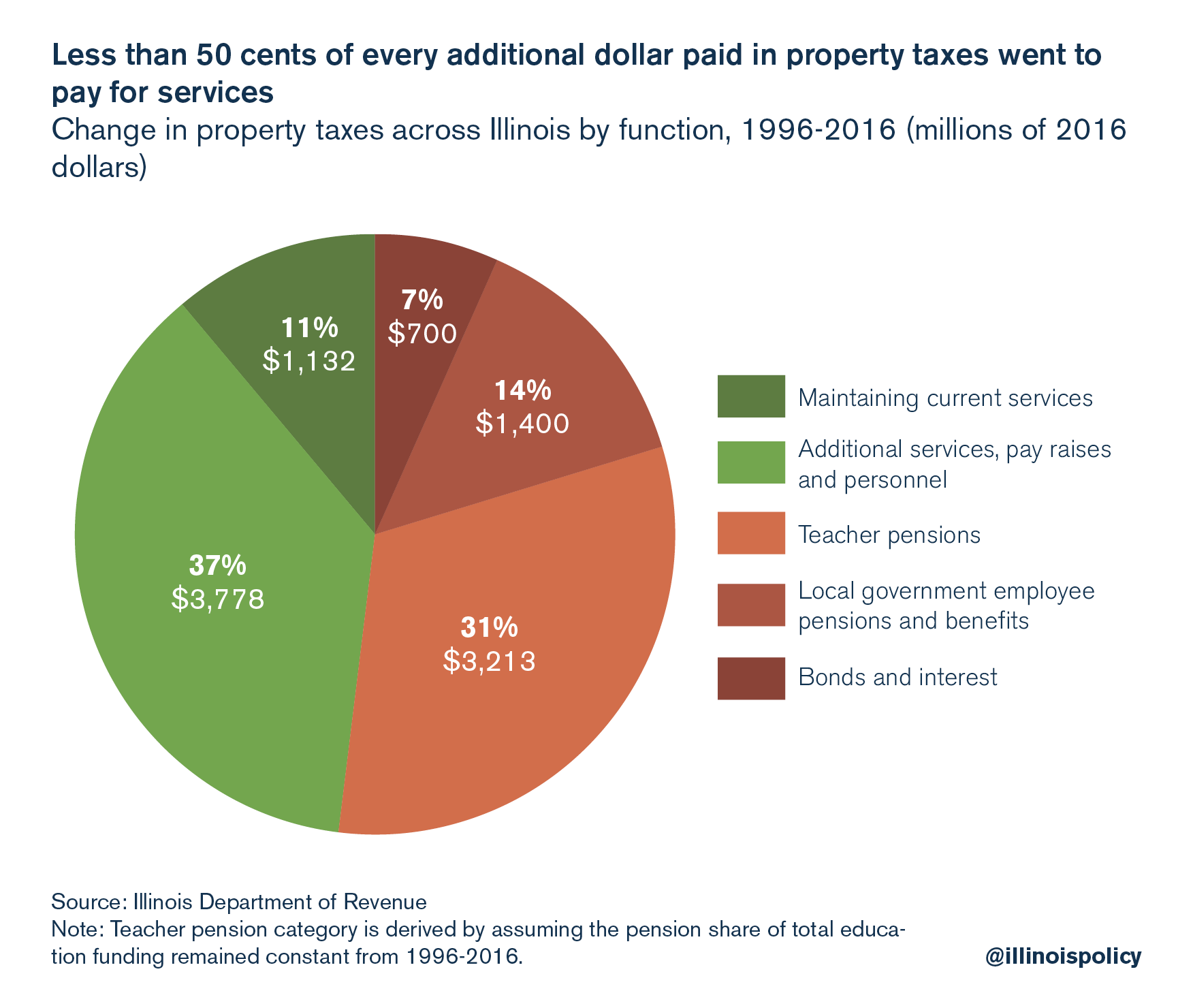

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Online Payment System Tim Brophy

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Property Tax Mchenry

Increasing Property Taxes Impact Land Owner Returns And Equilibrium Land Values Farmdoc Daily

Property Taxes By State In 2022 A Complete Rundown

Property Tax Prorations Case Escrow

Youtube Language Subscrib And View Gk Knowledge Youtube Knowledge

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Pensions Make Illinois Property Taxes Among Nation S Most Painful Illinois Policy

No Delay This Time Ford County Property Tax Bills To Be Mailed Friday Ford County Chronicle

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)